Often clients have asked how car depreciation is treated in book-keeping and taxation and what about loan installments. Or, if the earnings have gone way over the tax card limit specified at the start of the year, would it help if they buy a new car or replace an older one? Better to know these things in advance to reduce the element of unpleasant surprise.

As per the Taxation rules depreciation of vehicles in business use usually happens as per Diminishing Balance Method at the rate up to 25%. In simple words, the value of the vehicle is divided by 4 and the sum is recorded as depreciation expense of that year. Same time, the value of the vehicle is reduced by the same amount at the end of the year. Next year, we will take the reduced value of the vehicle and again divide it by 4 and so on.

Suppose, you plan to buy an electric vehicle worth €40000 which has an option of VAT deduction. You may consider if you are going to claim VAT refund from the purchase price or record the vehicle at the gross price and leave VAT unclaimed.

Decision to claim VAT→

- Check the prerequisite to VAT deduction, outline here by Vero.

- In simple words, you can claim VAT for a car if you are going to use the car 100% in business and you maintain a logbook to prove that you haven’t driven even a tiny fraction for any other purpose.

- Upon sales of the vehicle, you have to pay back the VAT amount corresponding to the sales value of the vehicle or when you transfer the vehicle to your private ownership.

- Benefits could be considered as immediate VAT refund and smaller depreciation charge due the vehicle recorded at net value

- Better, if aim at higher reported earnings at year-end.

Decision of not to claim VAT→

- Now this is quite a strict criteria to maintain especially if this is the only car in your use. So, consider also not to claim VAT.

- There would be an option to use a car for personal use, though kilometers are to be noted in the logbook.

- Higher depreciation charge simply means less taxation.

- Better option if you plan to transfer the car to your personal possession a few years later.

Now, once you have gone through the VAT deduction point, adjust your vehicle purchase budget accordingly consider the following in totality.

- Depreciation

- Interest charges

- Invoicing charges

- Insurance & road taxes

- Electricity charging vs fuel costs etc.

Let’s take a hypothetical figure to analyze how depreciation and financing costs would impact your business revenue. Now, any savings from fuel, insurance and road taxes etc would offset this estimate. You can download the full table here.

| Gross Car Price | €40,000 |

| VAT 24% | €7,742 |

| Net Price | €32,258 |

| Monthly installment | €503 |

| Last installment | €14,073 |

| Interest Rate (fixed) | ~5% |

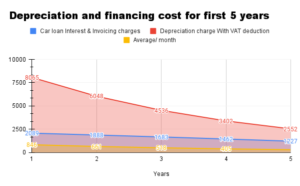

So, depending upon your decision of VAT treatment, projected expenses will look like this for the first five years.

| Years | Car loan Interest & Invoicing charges | Depreciation charge With VAT deduction | Average/ month | Depreciation charge Without VAT deduction | Average/ month |

| 1 | 2089 | 8065 | 846 | 10000 | 1007 |

| 2 | 1888 | 6048 | 661 | 7500 | 782 |

| 3 | 1683 | 4536 | 518 | 5625 | 609 |

| 4 | 1462 | 3402 | 405 | 4219 | 473 |

| 5 | 1227 | 2552 | 315 | 3164 | 366 |

Or, yearly values can be shown in a graph below.

Depreciation and financing cost for first 5 years

Hopefully, this calculation is useful if you are trying to maintain a certain level of income from your business.

Regarding the question, if car loan payment is a tax deductible expense or not, it is not and is rather a liability. The vehicle related expense is recorded based on the depreciation irrespective of whether it is financed or fully owned. However, if it is financed, the interest payment and invoicing charges are additional business expenses.